Abstract

Solana is a high-performance blockchain network engineered for large-scale applications, distinguished by its unique consensus mechanism that integrates Proof of History (PoH) with Proof of Stake (PoS). Solana's key features include:

In early 2023, Solana swiftly rebounded from the bear market, emerging as the third-largest public blockchain. Solana's Total Value Locked (TVL) surged more than thirtyfold, Solana's July DEX trading volume surpasses Ethereum for the first time, and projects like Render Network, Helium, and others have transitioned from Ethereum and its L2s to Solana.

This article will highlight some promising projects within the Solana ecosystem. Research on Solana's DePIN will be published later in a separate and detailed report.

Liquid Staking & Restaking

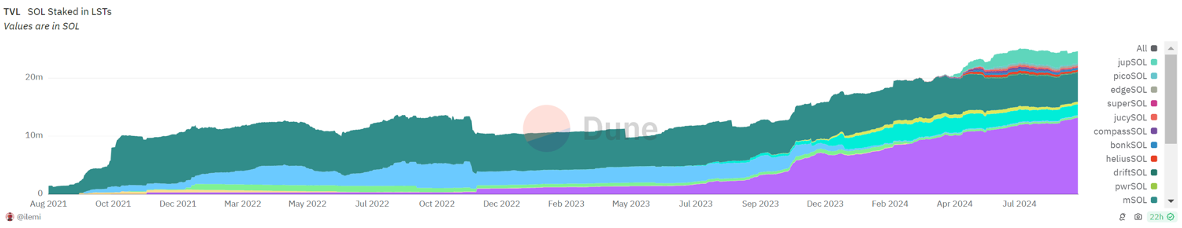

Solana's PoH mechanism is built upon PoS, yet there are distinct differences between Solana's and Ethereum's staking situation. Solana boasts a staking ratio of approximately 67.7%, considerably higher than Ethereum's 27.8%. However, Solana’s liquid staking ratio is merely 6.4%, significantly lower than Ethereum’s 32.4%. This discrepancy can be attributed to two key factors: Solana’s lack of a minimum stake amount and the application of slashing rules, which lower the entry barriers for solo validators. The lower use of liquid staking tokens (LSTs) in the DeFi ecosystem has limited demand for LSTs in the past.

Jito

Jito is Solana’s first liquid staking protocol to include MEV rewards, which distributes staking and MEV rewards to holders through its LST JitoSOL. Currently, 82.46% of validators run Jito-Solana, an open-sourced and audited validator client on Solana where validators can share MEV rewards. Jito's MEV rewards increase the JitoSOL APY from 7.80% of native staking to 8.35%, an increase of 7.05%. This excess return will become more significant with the surge in meme trading volume. Higher APY attracts investors to choose Jito over other liquid staking protocols.

The revival of the Solana DeFi ecosystem, the airdrop and good performance of the JTO token, the exit of its biggest competitor, Lido, from Solana, and the stable growth of MEV rewards have established Jito as the 1st protocol in Solana with $1.7 billion TVL and 47% market share. Jito continually erodes Marinade's market share because in the past, Marinade charged a 6% fee and Jito charged a 4% fee, but MEV revenue is not included in Marinade's mSOL. Therefore APY of mSOL is about 12% lower than that of JitoSOL.

However, the over 80% client adoption rate, the widespread introduction of MEV revenue, concerns over the over-concentration of LSTs share diminish the attraction and limit Jito's further growth. Other competitors also launch measures for improving yield to compete. For example, Marinade removed commission fees and launched The Stake Auction Marketplace (SAM), enabling Marinade stakers earn additional rewards from validator bids, APY of mSOL can reach 10% now.

To address these limitations and concerns about over-concentration, Jito has introduced Jito Restaking, an open-source, hybrid staking, restaking, and LRT module tailored for Solana. Collaborating with Renzo, Jito has launched Solana's first-ever LRT, ezSOL, which is minted by JitoSOL. Drawing a parallel to Ethereum, where the TVL of liquid restaking comprises about 30% of the total TVL of liquid staking, Solana’s restaking market has an estimated growth potential of approximately $1 billion. The introduction of Jito Restaking not only expands the applications of JitoSOL but also positions Jito to potentially become a combined entity like "Lido + Eigenlayer" on Solana. Moreover, by transferring the management of the Jito Stake Pool to StakeNet, a decentralized Solana staking pool, Jito can further decentralize stake pool operations and mitigate concerns of over-concentration.

JTO is the governance token with governance rights, boasting a $2.36 billion fully diluted value (FDV) and just a 12.4% circulating ratio. Big Unlock begins on December 8, 2024, and the inflation rate is 237% in the upcoming year.

Sanctum

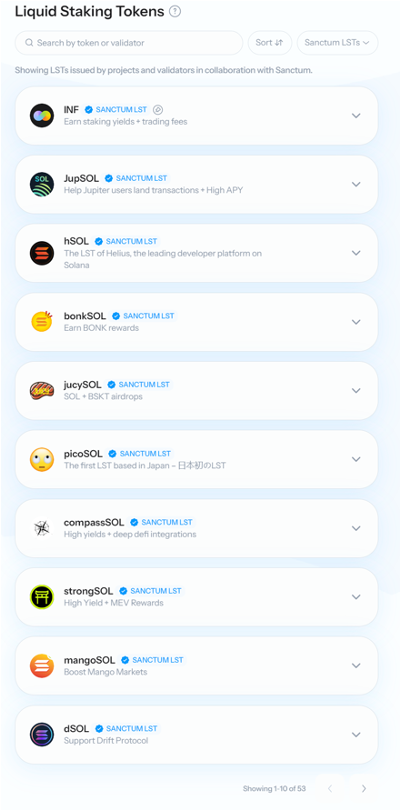

Sanctum is a liquid staking protocol on Solana, positioned as a liquidity layer for SOL LSTs, facilitating swaps between different SOL LSTs. Sanctum Infinity is a multi-LST LP that supports exchanges between any two LSTs of any size, whose LST is INF. Sanctum Reserve Pool, containing over 410,000 SOL, acts as a crucial shared source of liquidity for all staked SOL. Sanctum Router, leveraging the concept that an LST is a liquid version of a stake account, achieves efficient swaps between different LSTs. The positioning of Sanctum has led to an impressive increase in TVL by up to 40x in three months, currently standing at $745 million.

All LSTs deployed with Sanctum will have full access to Sanctum Router and Reserve and be tradeable on Jupiter. They are also eligible to be included in Sanctum Infinity for liquidity. Sanctum has already become the launch platform of Solana LSTs, and projects (protocols, CEXs, and even memes) collaborate with Sanctum to incentivize users to use their services through their own LSTs. For example, bonkSOL is backed by the BONK validator, which uses validator returns to reduce the BONK supply, and bonkSOL holders who hold more than 1 bonkSOL and more than 0.01 BONK can receive BONK airdrops. Diversified LSTs decrease concerns about over-concentration and make Solana's liquid staking ecosystem more prosperous. Sanctum is the biggest winner in this more decentralized and democratic industry landscape. The number of LSTs issued by projects and validators collaborating with Sanctum (such as JupSOL, INF, BonkSOL) has reached 53. Binance, Bybit, and Bitget also announced the launch of their SOL LSTs, with Sanctum LSTs achieving more than 20% of the market share and still growing.

In Sanctum's roadmap, Sanctum Profiles V2 will allow users to create personalized LSTs, and Sanctum Launchpad will leverage LSTs to support new projects and products within the Solana ecosystem.

CLOUD is the governance token with governance rights, boasting a $281 million FDV and just an 18% circulating ratio. Over the next year, the circulating supply of CLOUD will remain constant until a major unlock begins on 7/18/2025, when 12.5% of the total supply will be vested on the team and investors.

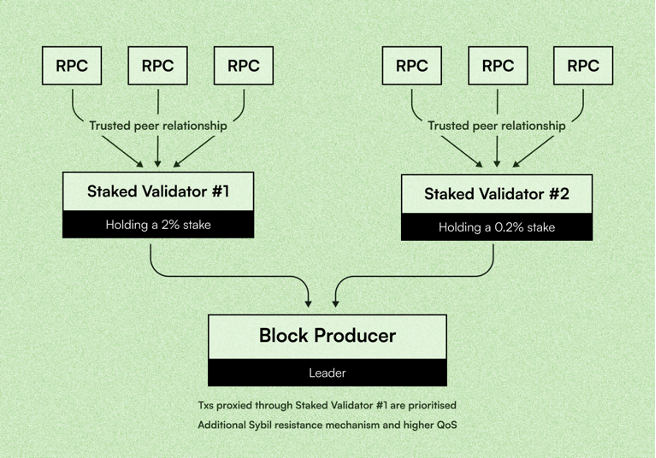

Solayer

Solayer is a liquid restaking protocol on Solana, which provides Endogenous AVS service and enables native Solana dapps to secure the network bandwidth with on-demand blockspace and throughput. By staking SOL, and selecting LSTs in exchange for its LRT STL, stakers can enjoy up to 9% APY on their deposits. The yield mainly comes from three sources: staking revenue, MEV and AVS fees paid by users. Solayer utilizes Stake-Weighted Quality of Service (QoS) to enable the more stake validators to hold, the higher the probability of successfully submitting transactions.

Endogenous AVS is a great innovation in Solana, so Solayer attracts huge investment and engagement. Binance Labs has announced its investment in Solayer, and the TVL of Solayer reached $168 million in two months. Focusing on Endogenous AVS now rather than exogenous AVS distinguishes Solayer from Jito Restaking, and provides an attractive yield for stakers, but whether users are willing to pay for the AVS fees determines how far Solayer goes. Solayer also plans to introduce exogenous AVS, which means Jito Restaking will be challenged.

DEX & Aggregator

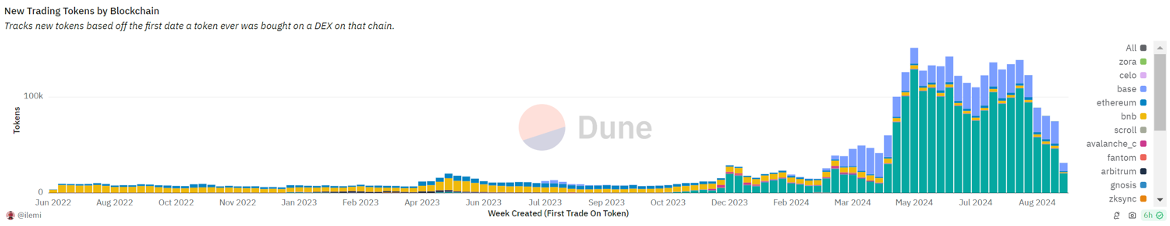

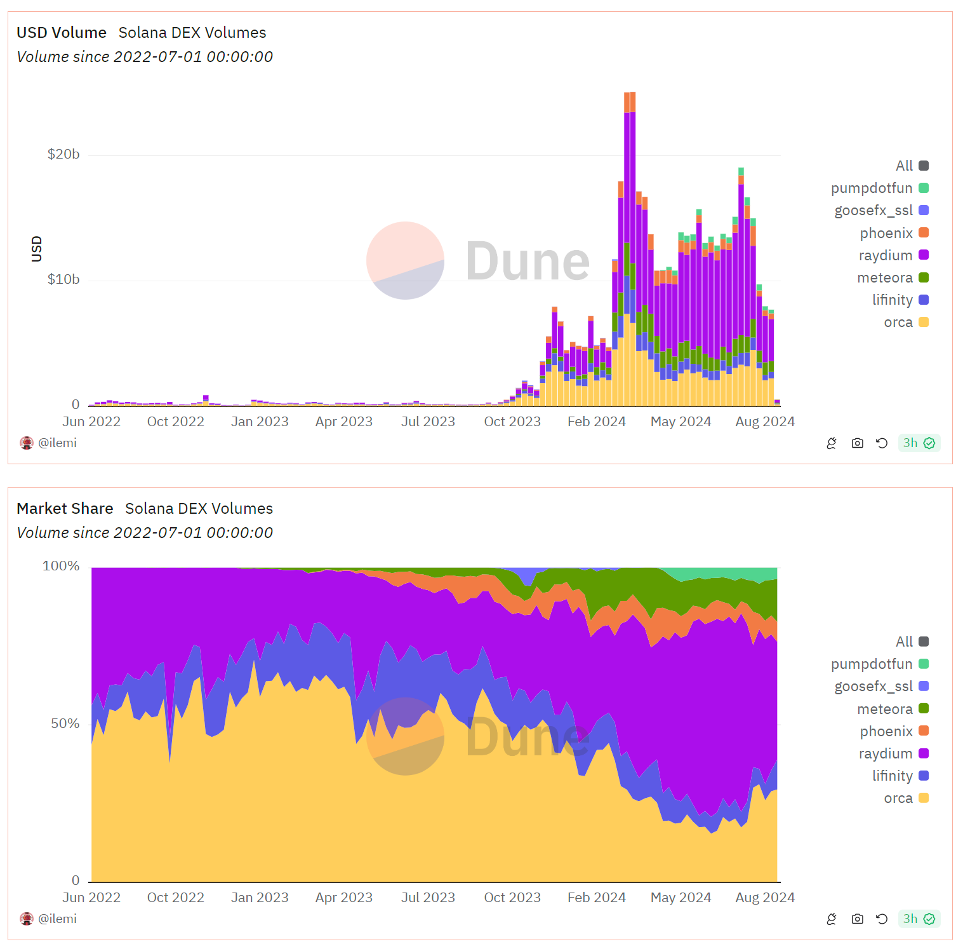

Solana's Trading Volume /TVL of DEXs is about four times that of Ethereum. Because of the rise in meme popularity, transaction activity on Solana is noticeably more active. This is evident in the approximately 100,000 new tokens issued daily at peak, with significant yields seen in tokens like Bome. The rise in meme popularity on Solana rather than other blockchains can be attributed to four key factors: the prevalence of casino culture (including memes and prediction markets), great wealth creation effects (as seen with Bonk, Wif, Bome, and Slerf), the development of infrastructures like Pump.fun and Dumpy.fun, and lower costs for token creation and transactions. In this bullish market cycle, DEXs and aggregators on Solana that offer lower entry barriers and a more seamless user experience for meme lovers are most likely to expand market share, enhance governance token value through receiving fees and distributing revenue, and serve as platforms for launching new assets.

Nevertheless, the bull market of memes on Solana can't persist indefinitely. Currently, approximately 60% of the trading volume on Solana is related to Pump.fun, only 1.4% of the memes created on the bonding curve can reach Raydium, and merely 3% of users can earn more than $1,000. An increasing number of rapidly launched memes divert users' attention and funds, and more advanced tools intensify PVP competition. SunPump on Tron and Four.Meme on BSC also attracts meme-lovers to transit to other blockchains for easier earning. Trading volume and numbers of new memes daily decrease to half of the peak. DEXs on Solana need more tradable assets with deep liquidity and stable intrinsic value.

Raydium

Raydium is the biggest DEX and first hybrid AMM on Solana, which can provide on-chain liquidity to OpenBook's central limit order book. In addition to its traditional standard AMM, Raydium offers a Concentrated Liquidity Market Maker (CLMM), which enables liquidity providers to specify a price range within which their liquidity is active for trades in a pool. Long-tail assets with high-volatility are typically created in the Standard AMM, and burning LPTs of AMMs encourages trading for it indicates part of liquidity won't diminish. The coexistence of both AMMs provides pool creators with diverse options, particularly in a market where standard AMM is more popular because various low-market cap memes on Solana are widespread. This flexibility is a key reason why Raydium has been able to capture market share from competitors like Orca, which exclusively offered CLMM in the past (Orca introduced Splash Pools, which supports full-range positions, in August 2024).

According to Raydium's docs, the minimum total creation fee collected for the protocol's development and operation is just about 0.435 SOL and suitable for meme lovers to create new tokens to capture popular culture (such as $FIGHT and $KAMA during Presidential Election 2024). Furthermore, Pump.fun, the most popular meme launchpad platform now, provides direct and tremendous users and trading volume injection to Raydium. Users can create memes by Pump.fun through its bonding curve. Memes whose market cap on the bonding curve reaches $69,000 can transit to AMM on Raydium, and Raydium will chop an extra 4 SOL as listing fees. Until 8/22/2024, Raydium's transaction fees daily average in 2024 is about 19 times more than in 2023, making Raydium's market share rise to at most more than 60% and stabilize at about 45%.

RAY is the governance token with governance rights, value accrual, and staking revenue, boasting an $833 million FDV and a circulating ratio of 47.5%. The locked RAY primarily stems from mining (34%) and Partnership & Ecosystem (30%), while the RAY belonging to investors, the team, and the community has already been unlocked. The trading fee for the AMM amounts to 0.25%, with 0.03% allocated to RAY buybacks. CLMM and CPMM feature similar buyback mechanisms. As of 8/22/2024, Raydium's average daily buyback fees in 2024 are approximately 27 times higher than those in 2023, and in 2024, annually, 5.9% of the maximum supply is subject to buyback. A healthy cash flow and continuous buybacks alleviate the team's selling pressure and enhance the intrinsic value of RAY.

In addition to the previously discussed decline in meme popularity on Solana, Raydium's low entry bar is easy to copy, and Raydium's position as a leading DEX might be challenged. The prosperity of low market cap memes also can't provide Raydium with durable liquidity depth. The introduction of Splash Pools, PYUSD liquidity pool and improved pool creation flow have made the market share of Orca begin to rise back, and it is also possible for Pump.Fun and Jupiter to establish their own DEX and seize Raydium's market share. Raydium must introduce new transaction objects or introduce new businesses (such as launchpad) in order to safeguard its painstakingly acquired market position.

Jupiter Exchange

Jupiter is the biggest DEX aggregator on Solana, providing diverse DeFi services. Compared to Ethereum, where Uniswap accounts for about half of the market share of DEXs and Curve is a concentrated place for swaps between stablecoins, the competitive landscape of DEXs on Solana isn't stable yet, and liquidity isn't concentrated enough. Therefore, optimal prices, low slippage, and efficient transaction execution through aggregators are especially important on Solana. DexScreener and other tools also help establish Jupiter's leading position through meme trading. Now, about 40% of DEX trading volume can be sourced from Jupiter, nearly double that of the biggest DEX Raydium.

Despite fierce DEX competition on Solana, the biggest downstream aggregator, Jupiter, will still benefit from the revenue growth driven by the increase in trading volume on all Solana DEXs.

Diverse and continuing product launches expand the usage and enhance user stickiness of Jupiter. Jupiter is more like the center of Solana ecosystem, like Binance in CEXs. Below are the main DeFi services of Jupiter:

• Limit Order, DCA and VA provide more investment tools.

• JupSOL, issued through Sanctum, earns staking yields and MEV kickbacks from Jupiter’s validator with no fees. JupSOL indicates Jupiter steps into the area of liquid staking, which will help make SOL retented in Jupiter. The market share of JupSOL rises to 10% in just 4 months.

• Perpetual trading expands Jupiter to the derivatives market as the biggest perpetual DEX on Solana, and OI is at $180 million now. At the same time, the Jupiter Liquidity Provider (JLP) Pool acts as a counterparty to perpetual traders, and holders of its LPT $JLP can earn extra yield from the trader's PnL and 75% of the generated fees by providing a maximum TVL of $700 million. The value of perpetual trading is captured directly by $JLP with 27.46% APY.

• Bridge Comparator supports Allbridge Core, Mayan, deBridge, and Onramper, bringing more capital from other blockchains and fiats to Jupiter.

• APE is Jupiter's attempt to stabilize and expand meme trades.

• LFG Launchpad is Jupiter's attempt to build the first community-driven launchpad, giving large-scale on-chain projects a reliable way to bootstrap a token on Solana. Memes Wen, cross-chain interoperability protocol deBridge, liquid staking protocol Sanctum, and other diversified projects have all been launched on it. Projects, proposals, candidates, votes (by JUP holders), and final launches can all be made transparently in the Jupiter community. One of the key mechanisms for the Jupiter LFG launchpad is a single-sided Meteora DLMM pool (based on Bonding Curves), which allows project teams to precisely determine price curves and distribute liquidity based on their preferences (such as Negative Exponential Curve to incentivize early adopters). LFG Launchpad empowers JUP holders with bigger governance rights, and a fair price discovery mechanism. Projects launched by LFG Launchpad also tend to airdrop their tokens to JUP holders. In addition, projects launched by LFG Launchpad usually collaborate well with Jupiter, and their tokens are more attractive than tokens with high valuations but low circulating ratios. Jupiter's LFG Launchpad can become the super flow entrance of Solana and benchmark Binance's Launchpad in CeFi.

JUP is the governance token with governance rights, staking revenue, and airdrop credentials, boasting a $7.30 billion FDV and a circulating ratio of 19.9% after the supply reduction proposal was adopted on August 2024 (JUP Burn Reduction will happen in over 6 months). The team manages 50% of JUP, and the other 50% is earmarked for the community, 20% for the team, and will start vesting in February 2025 for 2 years. Active Staking Rewards (ASR) allows JUP holders to get rewards while staking JUP and voting.

Perpetual Exchange

Drift Protocol

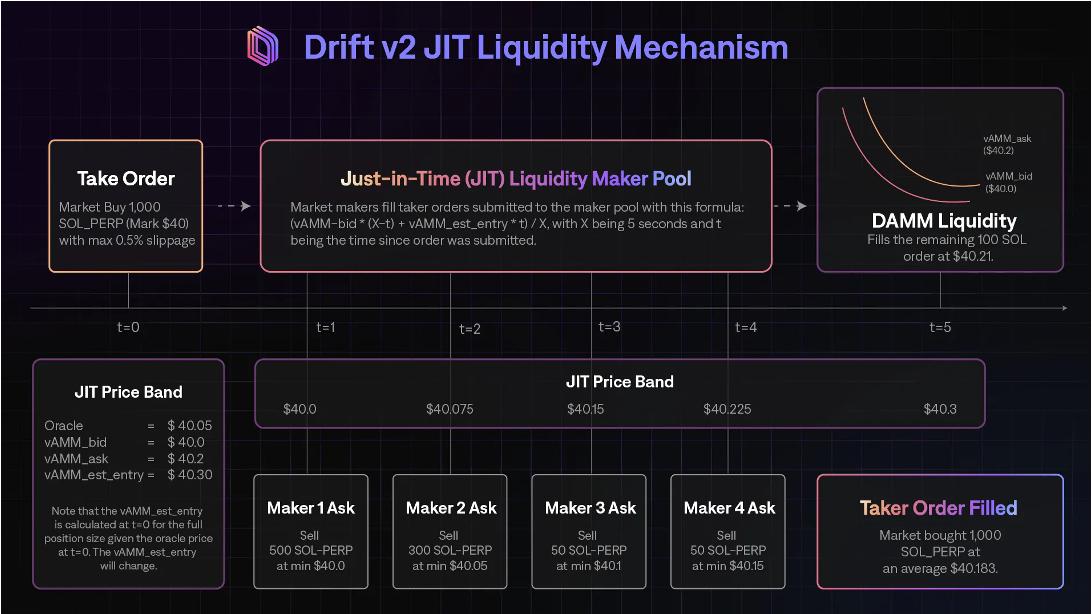

Drift is a decentralized trading platform built on Solana, offering a variety of features, including spot trading, leveraged trading, perpetual contracts, lending, and yield earning. Drift is the second biggest perpetual DEX on Solana with $365 million TVL. Trades on Drift are supported by three liquidity mechanisms sequentially:

• Just-in-Time (JIT) Auction Liquidity: When a taker submits a market order, this automatically triggers an individualized Dutch Auction with a specific start price, end price (start price ± slippage), and duration(~5 seconds). The earlier Market Makers (MMs) ask for the order with less profit, the more likely the order will be dealt with. JIT Auctions force MMs to compete and provide transactions with less latency and greater transaction depth.

• virtual AMM(vAMMs) Liquidity: If no MM steps in after the initial window, the taker can be fulfilled on Drift's vAMMs. vAMMs provide a transparent price discovery mechanism and balance the transaction depth and risk of high slippage.

• Decentralized Limit Orderbook Liquidity: Keepers listen, store, sort and fill valid limit orders by compiling all valid open orders found on-chain and organising them into each keeper's own off-chain orderbook. Keepers then listen to trigger conditions and match orders, and earn a fee for every trade they execute.

The Trading Volume of spots on DEXs is about 10% of that on CEXs, but the OI for perpetual contracts on DEXs is less than 3% of that on CEXs, indicating significant potential for growth in this area. DEXs and aggregators, which already have mature spots businesses, like Jupiter, which is Drift's biggest competitor, are easier to expand to the perpetual contract market. However, the limited transaction depth compared to CEXs remains a significant challenge for DEXs in increasing OI.

To diversify its offerings, Drift launched a prediction market BET in August. The prediction market is expected to gain traction, particularly in a U.S. Presidential Election year, due to the heightened demand for betting on political events. Polymarket, the leading prediction market, has reached a TVL of $100 million on Polygon. Drift's natural advantages support its expansion into the prediction market: Drift's TVL is four times larger than Polymarket's, and the strong interest in gambling among meme enthusiasts on Solana aligns well with prediction markets. In just half a month, total bets on BET have reached $23 million.

DRIFT is the governance token with governance rights and fees payment (in the form of fee discounts based on DRIFT staked in the vault), boasting a $456 million FDV and just a 21.3% circulating ratio. DRIFT emissions are scheduled over five years, after which all tokens will fully circulate, with 53% allocated for ecosystem growth.

Lending Protocol

Kamino Finance

Kamino is the first DeFi protocol that unifies Liquidity, Lending, and Leverage into a single, secure DeFi product suite. Although it was established during the bear market in 2022, Kamino rapidly became the largest lending and market-making protocol on Solana, achieving a market size of $1.7 billion, with over $1 billion in cumulative debt and capturing more than 60% of the lending market share. As the leading lending protocol, Kamino plays a crucial role in many pivotal projects on Solana. For instance, PYUSD, the sixth-largest stablecoin with an $840 million market cap, has 42% of its total, or $350 million, managed through Kamino's services. Below is a brief overview of Kamino's main business operations:

• Lending: Kamino Lend V2, built on the foundational layer of V1, uses modularity in the market layer to create markets with any combination of assets and unique risk configurations. In addition, single-asset lending vaults in the Vault Layer automate liquidity aggregation across various markets. By combining these features with a more robust Liquidation Engine (including limit orders and liquidation auctions) and Risk Management Architecture (Isolated Mode, Cross Mode, and Interest Rate Premiums), Kamino Lend V2 can become the cornerstone of Solana's "DeFi Lego." It supports extensive use cases, such as RWAs, Long Tail Assets, P2P lending, and Orderbook Lending on the Solana network. As the bull market approaches, lending will be the most direct method to increase the leverage ratio across Solana's DeFi ecosystem, positioning Kamino to benefit from the growing demand for combinable lending services.

• Liquidity: Kamino's liquidity vaults offer an automated liquidity solution that enables users to earn yield on their crypto assets by providing liquidity to CLMMs. The automation of the entire LP process, including automated position rebalancing, auto-compounding trading fees & additional incentives, enhances capital efficiency while reducing impermanent loss and price volatility. Depositors receive yield-bearing, easily liquidatable LPT kTokens, which can be accepted as collateral in K-Lend, enabling the creation of diversified strategies to earn money, such as Yield Loop and Delta Neutral, by borrowing against or looping their LP positions.

• Leverage: K-Lend utilizes a single liquidity market to centralize liquidity and improve efficiency, while the 'eMode' mechanism enables higher leverage when lending or borrowing within a specific asset grouping.

KMNO is the governance token of Kamino with governance rights and staking revenue, boasting $482 million FDV and a circulating ratio of just 13.5%. The circulating supply of KMNO will remain constant until a continuing unlock begins on 4/30/2025. From that date, every month, 2.2% of KMNO's total supply will be cliffy unlocked and vested with Key Stakeholders & Advisors, and Core Contributors, continuing until Apr 30, 2027. The remaining 37.5% of KMNO is vested in Community & Grants (27.5%) and Liquidity & Treasury (10%) to incentive builders and long-time users of Kamino Finance.

Save Finance

Save, originally known as Solend, is the third-largest lending protocol on Solana, with $242 million on TVL. The rebranding to Save coincided with the launch of additional DeFi products, including an LST saveSOL, a stablecoin sUSD, and a meme coin shorting platform, dumpy.fun.

SLND is the governance token of Save with governance rights and liquidity mining revenue, boasting a $72 million FDV and a circulating ratio of 40.1%. The mechanism of dumpy.fun means shorted assets will contribute to expanding the scale of Save's lending service, but the introduction of a new governance token, DUMP, may directly capture the platform's value, potentially overshadowing SLND.

Interoperability

Wormhole

Wormhole is one of the biggest underlying interoperation platforms. Its core is a generic message-passing Protocol, which provides developers with access to liquidity and users across more than 30 mainstream blockchain networks to build a wide range of applications on top of it. In November 2023, Wormhole raised a total of $225 million from Coinbase Ventures, Multicoin Capital, Jump Trading, and other famous VCs at a valuation of $2.5 billion.

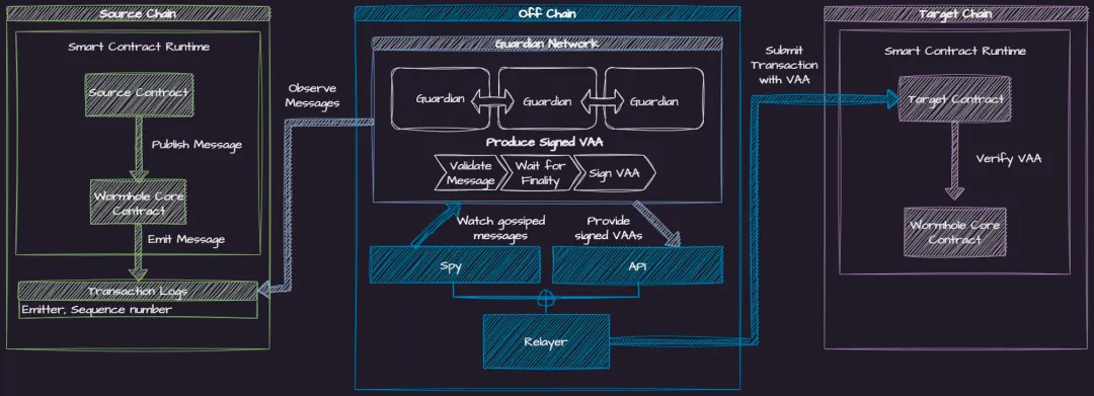

A Proof of Authority (PoA) mechanism, which consists of 19 Guardians and is the foundation of Wormhole's organizational structure, is well-known and reputable. They composed an off-chain Guardian Network to serve as Wormhole's oracle. Each Guardian independently signs the Verified Action Approvals (VAAs) and these signatures are eventually combined into a multi-signature and is considered valid when at least 2/3 of the Guardians (e.g. 13 out of 19) sign the same message. Core Contracts receive cross-chain requests from applications on the source chain, emit messages to Guardians, and verify VAAs on the target chain. Relayers are responsible for transmitting VAAs to the core contract on the target chain. The Guardian Network functions as an "External Validator," offering high scalability and broad applicability while avoiding single points of failure (SPOF). However, its security is contingent on the Guardians' unified and fraud-free verification, which could be a vulnerability in cross-chain messaging and asset transfers.

Wormhole has introduced four key products: the Generic Message-passing Protocol "Messaging", the Cross-chain Bridging Tool "Connect", the Cosmos-SDK chain "Gateway" and the Cross-Chain Query Tools "Query". Additionally, the Wormhole Foundation has launched several initiatives to foster project development, including the xGrant Program, Base Camp, and the Cross-chain Ecosystem Fund (CCEF, total value of $50 million). These initiatives provide funding, guidance, and resources to support the growth of the ecosystem. Until 8/31/2024, Wormhole sent over 1.047 billion messages, surpassing second-ranked LayerZero by 7.7 times. Looking ahead, Wormhole's roadmap includes the launch of Wormhole Institutional, which will offer interoperability solutions for global enterprises and financial institutions.

W is the governance token with governance rights, boasting a $2.1 billion FDV and a circulating ratio of 25.8%. W was initially launched as a native Solana SPL token, and ERC20 functionality will be enabled after launch through Wormhole's Native Token Transfers (NTT). W holders can stake their W and participate in proposals in different chains through Wormhole's NTT. Multichain governance will aggregate capital and users from different chains to build greater community and consensus. If W holders can participate in related DeFi activities and earn revenue from protocol, the intrinsic value of W will be more solid.

Oracle

Pyth Network

Pyth Network is the third biggest oracle with $4.85 billion TVS. It offers real-time price feeds for cryptocurrencies, equities, foreign exchange pairs, ETFs, and commodities from 100+ trusted first-party publishers to 350+ protocols on 55+ blockchains. Pyth's core team has worked in Jump Trading. Delphi Digital, HTX Venture, Multicoin Capital, and other famous VCs invested in Pyth.

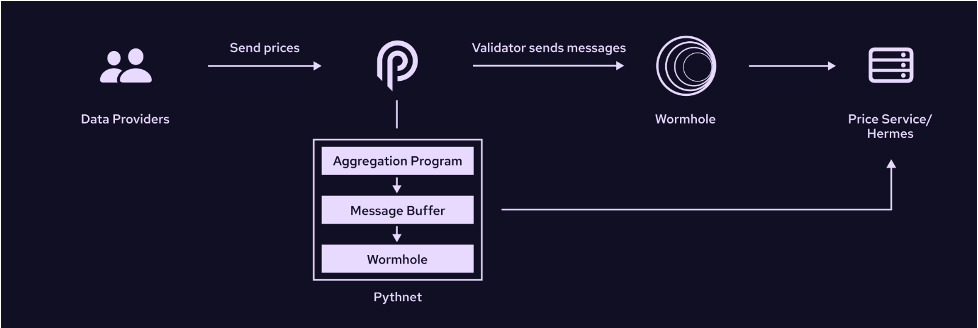

The core mechanism of Pyth is the pull oracle update model. In contrast to push oracles (such as Chainlink), pull oracles only update the on-chain price when requested. Users can request the latest price update from an off-chain service, and anyone can submit a price update to the on-chain Pyth contract, which verifies its authenticity and stores it for later use. Pyth encourages and empowers the original owners of financial data to directly contribute it to Pythnet, a specific blockchain run by Pyth's data providers. Then Pythnet securely combines the data provider's prices into a single aggregate price for each Pyth price feed and delivers pricing to other chains via the Wormhole cross-chain messaging protocol. The price server Hermes continuously monitors Pythnet and Wormhole, stores the latest price messages, and provides them to Dapps and smart contracts. Pyth provides an active price retrieval mechanism with high-resolution, high-fidelity, transparent data and low-latency, high-frequency updates (every 400 milliseconds). Collaborations with Wormhole make it easy for Pyth to extend to different chains through Wormhole's general message-passing protocol. Pyth is highly suitable for applications in financial scenarios where market volatility is high or rapid trade execution is critical, such as in derivatives and margin trading.

PYTH is the governance token with governance rights, boasting a $2.7 billion FDV and a circulating ratio of 36.2%. 52% PYTH is allocated to ecosystem growth, and 22% PYTH is allocated as publisher rewards to encourage accurate and timely price data. Every May, there will be a heavy unlock of PYTH lasting for about one month, continuing until 2027. Therefore, be cautious about adding to your position during this period.

Conclusion

Compared to Ethereum, Solana fosters a more dynamic and innovation-driven environment. Its high throughput and low fees significantly enhance the efficiency of dApps and attract a diverse array of projects to its ecosystem, fuelling rapid growth. The Solana Foundation plays a crucial role in promoting a product-focused, decentralized, and democratic environment, which accelerates mass adoption. Innovative projects like Blink, Pump.Fun, and dumpy.fun emerge and evolve swiftly to meet the market's evolving demands. As capital and talent increasingly converge on Solana, the ecosystem offers compelling investment opportunities, particularly during technological breakthroughs or favourable market conditions.

However, the positive correlation between Solana's performance and that of its projects is more obvious than that between Ethereum and its ecosystem, suggesting that Solana's ecosystem is still in a less mature stage of development relative to Ethereum.